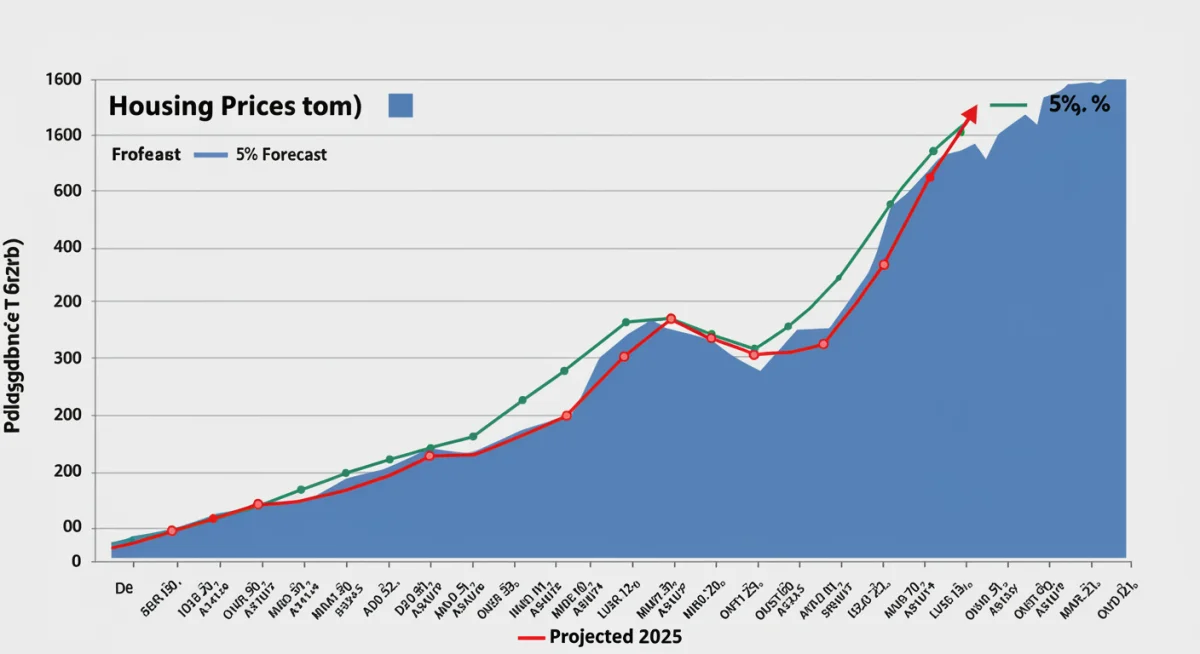

2025 Housing Market: Key Trends & 5% Growth Forecast

Anúncios

The 2025 housing market is projected for a 5% growth, driven by evolving interest rates, constrained inventory, and shifting demographic demands. Understanding these key trends is vital for navigating the upcoming real estate landscape effectively.

As we approach 2025, the housing market stands at a pivotal juncture, promising both opportunities and challenges. This comprehensive analysis aims at decoding the 2025 housing market: key trends and a 5% growth forecast for the next 12 months, providing clarity for prospective buyers, sellers, and investors across the United States. We will delve into the economic forces, demographic shifts, and policy impacts that are set to shape real estate, offering a detailed perspective on what to expect.

Anúncios

Economic fundamentals shaping the 2025 housing market

Understanding the economic landscape is paramount to predicting the trajectory of the housing market. Several fundamental economic factors are poised to significantly influence housing activity and values in 2025. These include inflation, employment rates, and overall economic growth, all of which create a complex interplay that directly impacts affordability and consumer confidence.

The Federal Reserve’s monetary policy, particularly concerning interest rates, remains a leading indicator. Any adjustments to the federal funds rate will inevitably ripple through mortgage rates, affecting borrowing costs for homebuyers. A stable or slightly declining interest rate environment could provide a much-needed boost to buyer demand, while persistent high rates might continue to temper market activity.

Interest rate projections and their impact

Economists widely anticipate a period of relative stability, or even slight reductions, in interest rates through 2025. This outlook suggests a more favorable environment for mortgage affordability compared to recent years. Lower rates can increase purchasing power, drawing more buyers into the market.

Anúncios

- Mortgage affordability: Reduced interest rates can make monthly mortgage payments more manageable, widening the pool of eligible buyers.

- Buyer confidence: A stable rate environment fosters greater confidence among potential homeowners, encouraging them to make significant investment decisions.

- Refinancing activity: Lower rates could also spur a wave of refinancing, freeing up capital for some homeowners and potentially stimulating other areas of the economy.

Ultimately, the actions of the Federal Reserve will serve as a critical barometer for the housing market’s health. Their decisions are not made in isolation but are a response to broader economic conditions, including inflation and employment data. A careful balance is sought to ensure economic stability without stifling growth.

The interplay of these economic fundamentals creates a nuanced picture for the 2025 housing market. While some headwinds may persist, particularly concerning inventory, the overall economic outlook suggests a foundation for moderate growth. This underpins the 5% growth forecast, signaling a market that, while not without its challenges, is expected to remain robust.

Inventory challenges and supply-side dynamics

One of the most persistent and impactful challenges facing the housing market is the ongoing issue of limited inventory. For several years, the supply of available homes for sale has struggled to keep pace with demand, contributing to rising prices and competitive bidding wars. This trend is expected to continue into 2025, albeit with some subtle shifts.

New construction, while increasing, has not been sufficient to fully alleviate the shortage. Builders face various hurdles, including labor shortages, rising material costs, and regulatory complexities. These factors collectively slow down the pace of new home completions, exacerbating the supply-demand imbalance.

Factors constraining housing supply

Several key elements contribute to the current supply-side dynamics, making it difficult for the market to achieve equilibrium. Understanding these constraints is crucial for anticipating market behavior.

- Existing homeowner reluctance: Many current homeowners, who locked in historically low mortgage rates, are hesitant to sell. Moving would mean taking on a new mortgage at a higher rate, effectively reducing their purchasing power or increasing their monthly payments.

- Construction costs: The cost of building new homes remains elevated due to the price of land, materials, and skilled labor. This impacts the affordability of new builds and the profitability for developers.

- Zoning and regulatory hurdles: Local zoning laws and lengthy permitting processes can significantly delay or even prevent new housing developments, particularly in high-demand urban and suburban areas.

The scarcity of available homes directly influences pricing. When demand outstrips supply, prices tend to rise. This dynamic has been a primary driver of housing appreciation in recent years and is expected to contribute to the projected 5% growth in 2025. While some markets may see slight improvements in inventory, a widespread return to pre-pandemic levels is unlikely in the short term.

Addressing these supply-side challenges requires a multi-faceted approach, including policy changes to streamline construction, incentives for homeowners to sell, and continued investment in infrastructure to support new developments. Without significant changes, inventory constraints will remain a defining characteristic of the 2025 housing market, influencing both price appreciation and market accessibility.

Demographic shifts driving housing demand

The demographic landscape of the United States is undergoing significant transformations, and these shifts are powerful forces shaping housing demand. Understanding who is buying, where they want to live, and what they prioritize is essential for predicting future market trends. Millennials and Gen Z, in particular, are emerging as dominant forces in the housing market, bringing with them distinct preferences and financial considerations.

Millennials, now firmly in their prime home-buying years, continue to form new households and seek homeownership. Despite facing affordability challenges, their sheer numbers ensure a consistent base of demand. Gen Z, while younger, is also starting to enter the market, often looking for more flexible living arrangements or entry-level homes.

Generational buying patterns and preferences

Each generation exhibits unique characteristics that influence their housing decisions. These preferences impact everything from home size and location to desired amenities and community features.

- Millennials (Born 1981-1996): Often prioritize suburban living, good schools, and access to amenities. They are increasingly looking for larger homes to accommodate growing families and remote work needs.

- Gen Z (Born 1997-2012): Show a strong interest in sustainability, smart home technology, and walkable communities. Many are open to urban living or smaller, more efficient homes.

- Baby Boomers (Born 1946-1964): A significant portion are looking to downsize or relocate to retirement-friendly areas, potentially freeing up larger family homes but also competing for smaller, more accessible properties.

Beyond generational shifts, migration patterns also play a crucial role. Remote work capabilities have allowed many individuals and families to move away from traditionally expensive coastal cities to more affordable, growing regions. This redistribution of the population creates new pockets of demand and puts pressure on housing markets in previously less competitive areas.

These demographic trends, combined with the ongoing formation of new households, provide a robust foundation for continued housing demand. While affordability remains a hurdle for many, the sheer volume of potential buyers from these large generations ensures that the demand side of the equation will remain strong, contributing significantly to the projected 5% growth in the 2025 housing market.

Regional variations and market hotspots

While a 5% national growth forecast provides a broad overview, the U.S. housing market is far from monolithic. Significant regional variations will continue to define market performance in 2025, with certain areas experiencing more rapid appreciation and others facing slower growth or even slight corrections. Understanding these localized dynamics is crucial for making informed decisions.

Factors such as job growth, population migration, affordability, and local economic policies all contribute to the disparity in regional market performance. Areas with robust job markets and an influx of new residents are likely to see sustained demand and price increases, while regions with slower economic growth or an oversupply of housing may experience more subdued activity.

Emerging market hotspots and cooling areas

Several regions are consistently identified as potential hotspots for growth, while others may see a more tempered market. These trends are influenced by a combination of economic and social factors.

- Sun Belt states: States like Florida, Texas, Arizona, and parts of the Carolinas are expected to continue attracting residents and businesses, fueling strong housing demand and price appreciation.

- Midwest resilience: Some Midwestern cities with diversified economies and relatively affordable housing may experience steady, sustainable growth as people seek value.

- Coastal market adjustments: Historically expensive coastal markets, particularly in California and the Northeast, might see slower appreciation or even slight price adjustments as affordability challenges persist and out-migration continues.

Local government policies, such as investments in infrastructure, zoning reforms, and tax incentives, can also play a significant role in shaping regional market performance. Cities and states that actively work to address housing supply issues and attract businesses are often better positioned for sustained growth.

For buyers and sellers, understanding these regional nuances is key. What holds true for the national average may not apply to a specific metropolitan area or even a particular neighborhood. Researching local market conditions, consulting with local real estate professionals, and analyzing hyper-local data will be essential for navigating the diverse landscape of the 2025 housing market and capitalizing on its varied growth opportunities.

The role of technology and innovation

Technology continues to revolutionize nearly every industry, and real estate is no exception. In 2025, technological advancements and innovative solutions will play an increasingly critical role in shaping how homes are bought, sold, and managed. From AI-powered analytics to virtual reality tours, technology is enhancing efficiency, transparency, and accessibility in the housing market.

The integration of artificial intelligence and machine learning is providing more accurate market predictions, personalized property recommendations, and streamlined transaction processes. These tools empower both real estate professionals and consumers with better data and insights, leading to more informed decisions.

Key technological advancements in real estate

Several technological trends are set to significantly impact the housing market in the coming years, transforming various aspects of the buying and selling journey.

- AI-driven market analysis: Sophisticated algorithms can analyze vast datasets to identify emerging trends, predict price movements, and assess investment opportunities with greater precision.

- Virtual and augmented reality: Immersive VR tours allow prospective buyers to explore properties remotely, saving time and expanding their search radius. AR can help visualize renovations or furniture placement.

- Blockchain for transactions: While still nascent, blockchain technology has the potential to streamline and secure real estate transactions, reducing paperwork and increasing transparency.

Smart home technology is also becoming a standard expectation for many buyers, influencing property values and desirability. Features like energy-efficient systems, smart thermostats, and integrated security systems are increasingly sought after, reflecting a broader trend towards sustainability and convenience.

For real estate professionals, embracing these technologies is no longer optional but essential for remaining competitive. For consumers, these innovations offer unprecedented access to information and tools, making the home buying and selling process more efficient and user-friendly. The ongoing evolution of technology will undoubtedly contribute to the dynamism and efficiency of the 2025 housing market, supporting its continued growth and adaptation to modern demands.

Policy and regulatory influences on the market

Government policies and regulatory frameworks wield substantial influence over the housing market. From federal initiatives to local zoning ordinances, these measures can either stimulate or constrain housing activity, impacting everything from affordability to supply. In 2025, policymakers will continue to grapple with persistent housing challenges, and their decisions will play a significant role in shaping market outcomes.

At the federal level, discussions around housing affordability, mortgage lending standards, and support for first-time homebuyers are ongoing. Any changes to programs offered by agencies like the FHA or VA can have a widespread impact on borrower eligibility and market accessibility. Similarly, tax incentives related to homeownership or real estate investment can shift market dynamics.

Key policy areas affecting housing

Several critical policy and regulatory areas are expected to influence the 2025 housing market, requiring close attention from market participants.

- Zoning reform: Efforts to ease restrictive zoning laws and promote higher-density housing development are gaining traction in many areas, aiming to address supply shortages.

- Affordability initiatives: Federal and state programs designed to assist low- and middle-income buyers, such as down payment assistance or shared equity programs, can boost demand.

- Environmental regulations: New building codes and environmental standards may increase construction costs but also promote sustainable housing, aligning with broader societal goals.

Local governments also play a crucial role through property taxes, building permits, and infrastructure investments. High property taxes can deter homeownership, while efficient permitting processes can accelerate new construction. Investment in public services and infrastructure can significantly enhance the desirability and value of a community.

The balance between protecting existing homeowners, encouraging new development, and ensuring equitable access to housing is a delicate one. Policymakers face pressure from various stakeholders, and their decisions often involve trade-offs. The regulatory environment will continue to be a dynamic force, and its evolution will be a key determinant of the 2025 housing market’s performance, influencing the anticipated 5% growth and its distribution across different segments of the population.

Investment opportunities and future outlook

Against the backdrop of a projected 5% growth, the 2025 housing market presents a landscape ripe with investment opportunities for those who understand its nuances. While general market growth is anticipated, strategic investment will require careful consideration of individual market segments, risk tolerance, and long-term goals. Both residential and commercial real estate sectors will offer distinct avenues for potential returns.

Residential real estate, particularly in growth markets driven by demographic shifts and job creation, is expected to remain a strong contender for investors seeking appreciation and rental income. The continued demand for housing, coupled with limited supply, underpins this optimistic outlook.

Strategic investment considerations for 2025

Approaching the 2025 housing market with a clear investment strategy is essential. Several factors should guide decisions for both seasoned and new investors.

- Growth markets: Focus on regions experiencing strong job growth, population influx, and favorable economic indicators. These areas are more likely to see sustained property value appreciation.

- Diversification: Consider diversifying across different property types (single-family, multi-family, vacation rentals) or geographic locations to mitigate risk.

- Affordability focus: Properties in more affordable segments of the market may offer better entry points and stronger rental yields, especially as interest rates stabilize.

Beyond traditional residential investments, niche markets such as build-to-rent communities, senior living facilities, and properties optimized for remote work are also gaining traction. These specialized segments cater to specific demographic needs and emerging lifestyle trends, offering potentially lucrative returns.

The commercial real estate sector, while facing its own unique challenges (such as the evolving office market), also presents opportunities in areas like industrial logistics, data centers, and specialized retail. Investors should carefully assess the long-term viability and adaptability of commercial properties in a changing economic landscape.

Overall, the future outlook for the 2025 housing market, with its anticipated 5% growth, remains positive for discerning investors. Success will hinge on thorough market research, understanding localized trends, and adapting strategies to capitalize on evolving demands and economic conditions. The market will reward those who are agile and well-informed, ready to navigate its complexities and seize emerging opportunities.

| Key Trend | Brief Description |

|---|---|

| Economic Stability | Projected stable interest rates and economic growth support market confidence and affordability. |

| Inventory Shortage | Limited housing supply continues to drive prices up, particularly in high-demand areas. |

| Demographic Demand | Millennials and Gen Z entering prime home-buying years sustain strong buyer interest. |

| Regional Disparities | Market performance will vary significantly by region, with some areas seeing faster growth than others. |

Frequently asked questions about the 2025 housing market

The overall growth forecast for the 2025 housing market in the United States is approximately 5%. This projection is based on a combination of factors including stabilizing interest rates, sustained buyer demand from large demographic groups, and ongoing inventory constraints. However, regional variations will be significant.

Economists anticipate relatively stable or slightly declining interest rates in 2025. This could improve mortgage affordability for many buyers, potentially increasing their purchasing power and drawing more individuals into the market. Lower rates make monthly payments more manageable, easing financial pressures.

Yes, the housing supply shortage is expected to persist into 2025. While new construction is increasing, it’s generally not enough to fully meet demand. Factors like existing homeowner reluctance to sell and high construction costs continue to limit available inventory, contributing to price appreciation.

Millennials, now in their prime home-buying years, will continue to be a primary driver of housing demand. Gen Z is also beginning to enter the market, seeking entry-level homes and flexible living arrangements. These large generational cohorts ensure a sustained pool of potential homeowners.

Technology will play an increasingly vital role through AI-powered market analytics, virtual reality tours, and streamlined transaction processes. These innovations enhance efficiency, transparency, and accessibility for both buyers and sellers, helping to modernize and optimize the real estate experience.

Conclusion

The 2025 housing market is poised for a dynamic year, characterized by a projected 5% growth driven by a complex interplay of economic forces, demographic shifts, and technological advancements. While challenges like inventory shortages and affordability concerns will remain, the underlying demand from key generational cohorts and a stabilizing interest rate environment suggest a resilient market. Navigating this landscape successfully will require a clear understanding of regional variations, an embrace of new technologies, and an informed approach to investment. For buyers, sellers, and investors alike, staying abreast of these key trends will be paramount to making strategic decisions and capitalizing on the opportunities that the evolving real estate market of 2025 is set to offer.